Finances and budgeting can be tricky to navigate, especially as a college student with an unstable income and OSAP loans. In my case especially given how I swap in between work and study terms my expenses and priorities can change drastically so I adjust my approach accordingly. Over the years I've found a couple of key concepts I try to live by to keep my finances in check.

Ultimately one of my biggest gripes with my finances has been guilt with spending, especially growing up in a frugal household for which I am thankful for the habits instilled upon me. I guess me writing this and thinking about how to efficiently budget and invest is my way to feel more in control of my finances.

1. Principles I live by

Do I really need it?

Before buying something I usually do a double think. Have I bought things like this in the past? How often am I still using it? Can I do without it? More times often than not the answer is usually no. This helps me avoid impulse purchases, for example:

Last year I had bought an exclusive UV long sleeved shirt at an annual dragonboat competition. It was quite pricey, but in the moment it seemed useful given the blazing sun and it was an exclusive shirt for the event. However I ended up never wearing it for whatever reason and it just sits in my closet. Fast forward to this year I was at the same competition but this time in Montreal. I ended up not buying the event merchandise and looking back on it now do not regret my choice. In general I try not to contribute to overconsumption as it would have probably just sat in my closet as well 💀

Work hard, play hard.

Invest in yourself. This is a huge lesson I've learned over the years. It's kind of a balance between budgeting and living life, especially as someone in their early 20s. Like living to eat or eating to live, I feel if you don't at least enjoy the fruits of your labour then what is the point of saving? Especially when I'm older and everyone is at different stages in life, I'd like to look back at my 20s and be proud of what I've done. Technically you could budgetmaxx and just live at your parent's home, eat instant ramen everyday and just work/sleep/eat. But life is about sharing experiences with friends and family, and I really try to embrace that.

So going by this virtue, if it's a cost for school, dragonboat, AWS training courses, or dinners with family and friends, I am more lenient when it comes to spending. Invest in yourself (therapy, education, skills, hobbies, people, gym) and you won't regret it. In the future I'd like my family to completely not worry about money anymore, so if I can earn enough to keep them happy while contributing to society in meaningful ways (charity, volunteering) then that is what I find is meaningful for me. The working hard part is for me to support that lifestyle and future goals, and upskilling for my career growth.

*Obviously there needs to be a balance, if you just play hard and spend money on takeout, then that would be overindulging. Also I wouldn't be satisfied with not working for something. Vice versa if you only work hard and never play then you will experience burnout and health complications in the long run. So my approach is to do both and strive to be a better version of yourself everyday.

2. My Budgeting Approach with Expenses

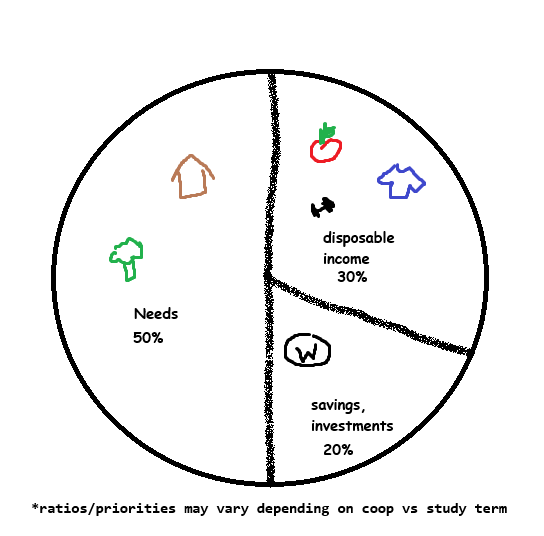

As I mentioned before, my expenses and priorities can change drastically based on whether I am studying in Waterloo or working (my past few coop terms have been in Toronto). I'm fortunate enough to have food and to be able to live with my parents during work terms, so when on a study term I am more frugal as I need to cover rent, food and tuition fees. As a general rule of thumb I try to follow the 50/30/20 rule but adjust it based on my situation. Earlier on when I started budgeting I used to keep most of my coop earnings in a savings account, but I really try to embrace the concept of letting your money work for you. I have a rainy days account for emergencies but I also invest the rest in ETFs. I know there are alternatives as well like managed portfolios or GICs. Anything really is better than nothing (inaction is the enemy!)

Here is a chart of how I budget using the 50/30/20 rule:

You can also try to take advantage of cashback and points programs to maximize your returns on spendings, or even target no-fee accounts/cards as well.

Conclusion

My main takeaway is that managing finances can get confusing and

stressful. However by setting a budget, regular investing and

concious spending you can better manage your money and feel less

bad for spending money on what matters most to you! In the coming

month I'll be helping build the Wealthsimple app which really

excites me being a long-time user

ever since they started doing those free food promos on campus

in first year

as my family and friends use it to invest too 😁🍁 so I'm looking

forward to building up my tech but also finance lingo and

knowledge in the next 4 months!